The Premise and Opportunity

The Looming Challenge for Family Businesses

The greatest wealth transfer in the history of the United States, brought about by the aging of the baby boomer generation, is expected to accelerate over the next decade, resulting in an unprecedented transfer of assets from family-held companies. The taxes due on this transfer will also be unprecedented.

Thousands of estates will need to embark on a search for liquidity to pay their estate taxes, a process that will be challenged by:

An ongoing bank credit contraction that is expected to worsen

A legislative environment that is anticipated to shift towards more punitive estate tax policies

Family-held businesses represent a significant market opportunity in the United States.

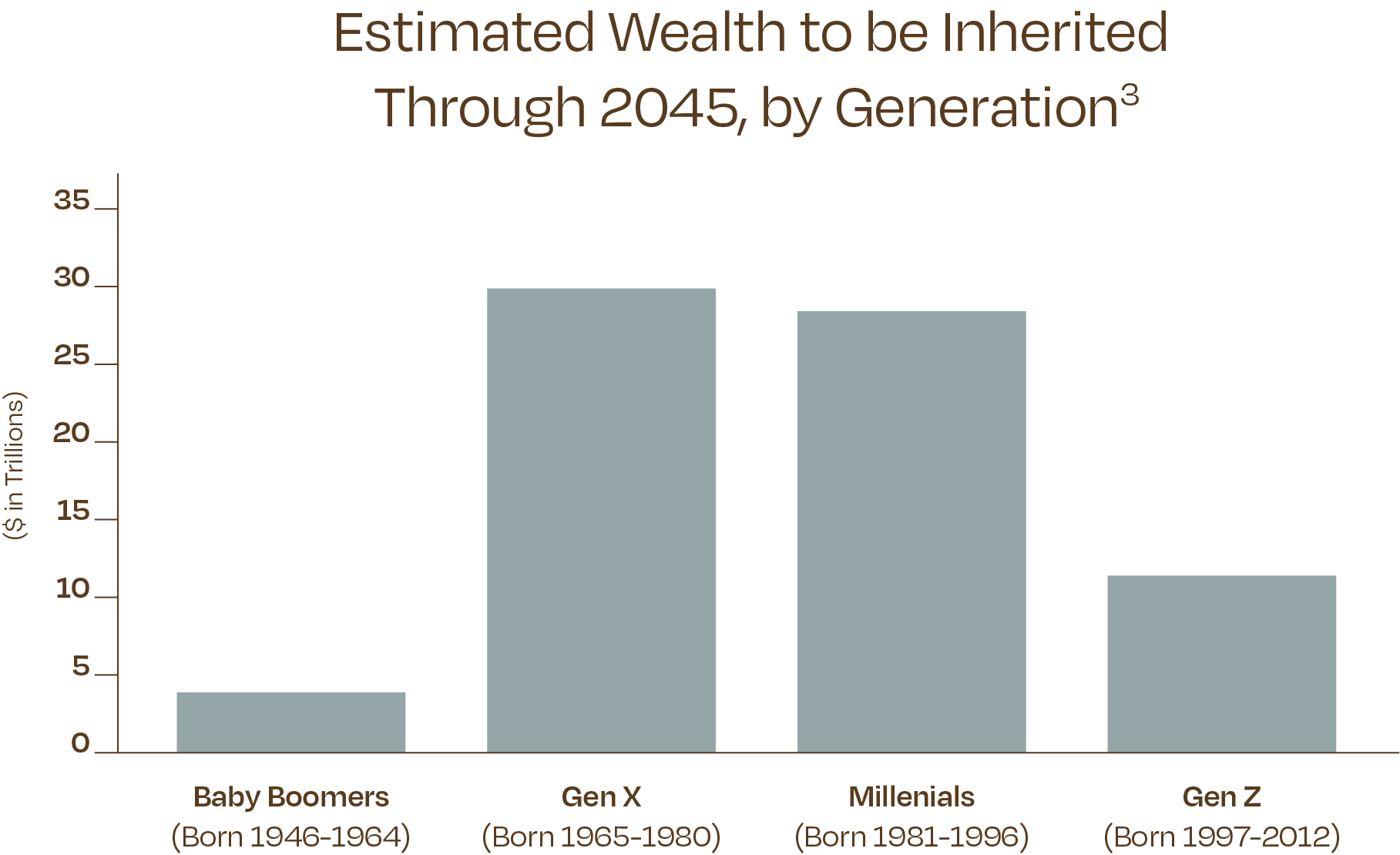

Trillions of dollars of family wealth are anticipated to be transferred over the next 20 years, which will drive the need for effective intergenerational transfers. Capri Capital Partners looks to fulfill this critical, yet underserved need for family-held businesses.

Market Overview

The Great Wealth Transfer

An estimated $72 trillion will change hands over the next 20 years.

This unprecedented transfer will include hundreds of thousands—if not millions—of family-held businesses.

This great wealth handover has long been anticipated, but recent studies show that it is underway and gathering momentum. According to UBS’ Billionaire Ambitions Report:

In 2023, for the first time in the history of the study, new billionaires acquired greater wealth through inheritance than entrepreneurship.⁴

During the next 20 to 30 years over 1000 of today's billionaires are likely to transfer more than $5.2 trillion to their heirs.⁴

References: 1. Smith Family Business Initiative at Cornell University. 2. Family Enterprise USA. (2024). Annual Family Business Survey. 3. Cerulli Associates. (2021). The Cerulli Report: U.S. High-Net-Worth and Ultra-High-Net-Worth Markets. 4. UBS. (2023, November 30). Billionaire Ambitions Report: The Great Wealth Transfer.